Background > Objective > Approach > Timeframe

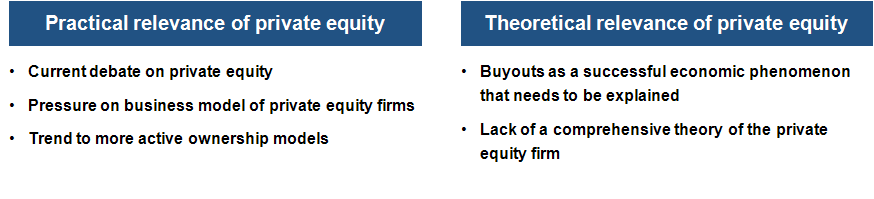

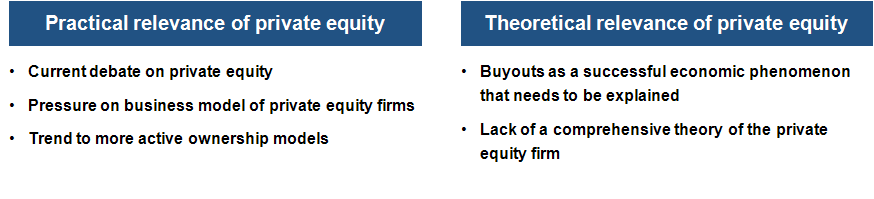

In recent years, buyouts have become an economically

important and controversially debated phenomenon across

Europe. Private equity firms and their value creation mechanisms are intensively

discussed in the general public and in the academic community, but also among

potential portfolio companies and private equity firms themselves. This debate

on the business model of private equity firms is of high relevance

for practitioners as well as academics.

The EUPE study2010 project is inspired by the different facets of the intense debate on private equity. To a large extend, the general public today is still unaware of what private equity firms actually do and how their business model works. People are asking themselves whether private equity firms have a beneficial impact on the long-term development of portfolio companies or operate on a harmful short-term investment horizon. Especially politicians and unions in the United Kingdom and Germany have harshly criticized the increased activity of private equity firms, leading to significant image problems of the industry.

Private equity firms have to find a convincing answer to face this critique. At the same time, current industry trends have put pressure on the traditional business model of private equity firms, which in turn have to find new ways to create value in order to keep up traditionally high returns for their investors. Thus, many private equity firms currently consider taking a more hands on approach, hoping to improve the value of portfolio companies through active influence and management support. However, it is questionable whether private equity firms can develop a sufficient level of understanding for the individual business models of portfolio companies and actually have the capabilities to support them.

The public debate on private equity firms as well as the traditionally

good economic performance of private equity firms have also drawn the interest

of scientists to the private equity industry. The academic

community is particularly interested in finding the reasons for the great success

of private equity firms and in transferring this knowledge to similar companies

and circumstances. At the same time, scientists are still trying to develop

a general theory of the private equity firm, which is able to explain all aspects

of private equity. Also, scientists are trying to generate objective empirical

data to put the debate on private equity on reliable facts.

The EUPE study2010 project’s goal is to make an objective contribution to the debate on private equity by using scientific concepts and methods to analyse how private equity firms act and create value. Our research focuses on answering the following central question:

“Are there consistent patterns of activities with value creating influence which can be viewed as typologies of private equity management styles?"” |

Based on the answer to this question, we want to derive insights for industry practitioners on the existence of different management styles observed in practice. We also want to foster the general understanding of private equity and help the academic community to develop a theory of the private equity firm.

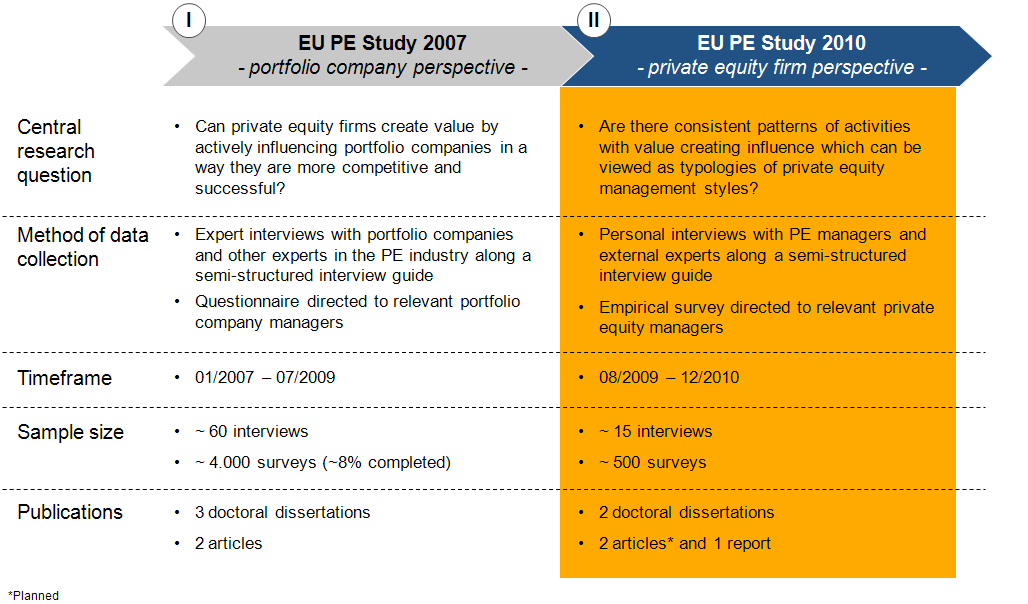

The EUPE study2010 is a follow-on project to the EUPE study2007.

To answer our central research question, we take a new conceptual approach to private equity. Unlike most

previous studies, we are not approaching private equity from a financial but from a strategic management perspective.

By modelling a private equity firm and its portfolio companies as a special type of multibusiness firm, we are able to

apply the extensive knowledge on value creation though active influence of parent companies to the context of private equity.

According to resource-based multibusiness firm theory, private equity firms can particularly create value by providing

portfolio companies access to potentially valuable resources.

Based on this general idea and a corresponding interpretation of value creation levers in buyouts,

we have developed a comprehensive model of activities with value creating influence by private equity firms. In order

to ensure completeness of the model and relevance for practitioners, we have discussed our model in semi-structured

interviews with about 60 industry experts before testing it with structural equation modelling techniques based on the

data generated through the EUpes2007 survey. In our first survey we were asking executives of portfolio companies on the

influence and effects of private equity firms on their companies. The survey was sent to over 4,000 European portfolio

companies with a response rate of close to 8% (>300 questionnaires completed).

The EUPE study2010 project marks the second wave of this academic research initiative. The model

of value creating influence by private equity firms will be adapted for an empirical survey directed to relevant

private equity managers. Unlike the EUpes2007 survey, the questionnaire of this study analyzes value creation from

a private equity firm perspective. The questionnaire will be sent to a selected group of private equity firms that

are active in the buyout space. In total, around 500 firms will be invited to participate in this research initiative.

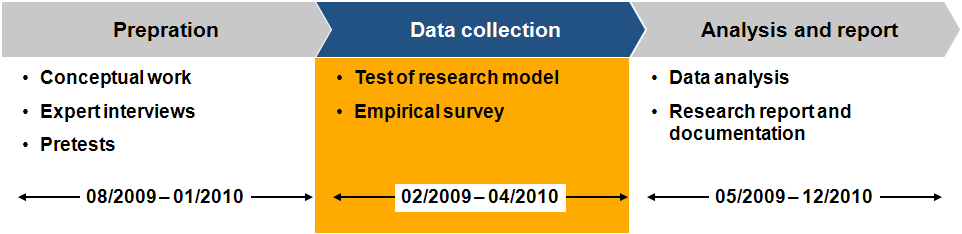

The EUPE study2010 project is set up for a total duration of one year: